In the past, municipalities have executed tax-exempt advance refundings. There are two reasons for an issuer to execute an advance refunding: (1) to lock in the refinancing’s cash flow savings by using the outstanding bond’s call provision, or (2) the need for the issuer to change an indenture provision associated with an outstanding bond issuance. Most advance refundings are executed to produce cash flow savings in the future, helping to relieve future budgetary needs.

Tax-exempt advance refundings were eliminated by the Tax Cuts and Jobs Act in 2017, to compensate for the loss of tax revenue caused by the nature of tax-exempt debt.

According to the Joint Committee on Taxation, eliminating tax-exempt advance refundings of tax-exempt bonds would save $16.8 billion over the next 10 years. A December 2017 estimate from the Joint Committee on Taxation projected that the repeal of this exemption in P.L. 115-97 would increase federal revenues by $17.4 billion over the FY2018-FY2027 period.

So, why are we even talking about advance refundings? Because issuers can execute an advance refunding with taxable bonds (a little more later). And over the past few years, lobbyists have been pushing Congress to return tax-exempt advance refundings.

Advance Refundings Explained

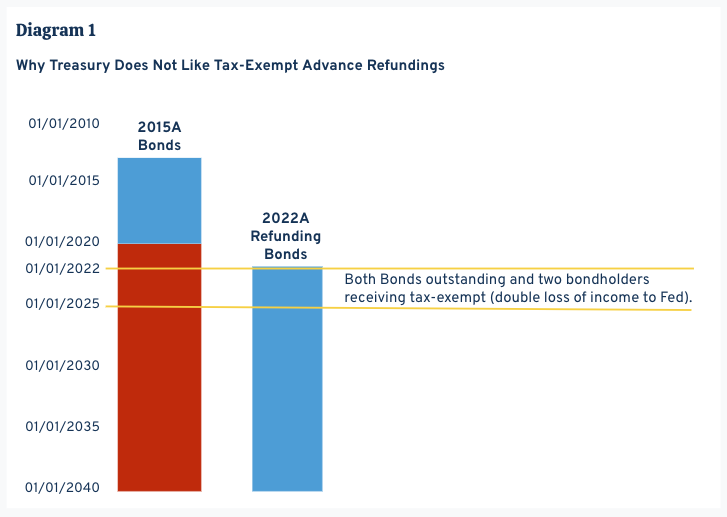

An advance refunding is when an issuer creates a portfolio of securities (i.e., escrow) more than 90 days prior to the outstanding bond’s actual call date, that will be used to pay off the outstanding bonds (i.e., call the bonds) and finances the portfolio of securities with new bonds at market rates. If being executed to produce cash flow savings, the new market rates will be lower than the original outstanding bonds market rates. Tax-exempt advance refundings, from a federal government revenue perspective, both the outstanding bonds and the refunding bonds are outstanding for at least 90 days until the refunded bond is taken away from the original owner (i.e., called) on its call date. This means that both the owner of the currently outstanding bond and the holder of the new advance refunding bond are receiving TAX FREE income at the same time, which is lost income to the treasury (see diagram 1).

Post-2017 if an issuer wants to advance refund outstanding bonds they have to execute the transaction with taxable bonds which are more expensive (i.e., higher yielding), thus reducing the economics of the transaction when compared with a hypothetical tax-exempt advance refunding.

Advance refundings for cash flow savings are usually analyzed by looking at the percentage of present value savings achieved versus the refunding bonds’ par amount. Per Section 149 of the Tax Code, a tax-exempt advance refunding can have only been executed once for any new money financings and never on a tax-exempt refunding transaction. Since, the savings achieved from an advance refunding can only be achieved once, the timing of when to execute an advance refunding is critical. Historically, issuers have targeted approximately 5%-7% present value savings when executing their one and only tax-exempt advance refunding on a specific project. Taxable advance refundings can be executed as often as an issuer thinks it makes sense, but the issuer loses the economic benefit of issuing tax-exempt advance refunding bonds.

Advance refunding mathematics is simple in a standard case. Diagram 2 pictorially displays the components of an advance refunding. The issuer sold bonds in 2015 that included a call date permitting the issuer to “take back” the bond at a specific price usually any time after the call date. Prior to the call date, the issuer executes the call on the existing bonds (Series 2015A) and pays the bondholder the value of the bond plus any call premium. To pay the bondholder for “taking back” the bond, the issuer sold new advance refunding bonds (Series 2022A) which had a lower future debt service cash flow than the original bonds, producing future cash flow savings. From a budgetary standpoint, the existing bonds are no longer the liability of the issuer and the new refunding bonds now have to be paid off with ongoing revenues from the budget.

The Mechanics of Advance Refundings are Complex

The actual mechanics of an advance refunding can be complicated due to the number of pieces involved. Before we jump into those, please note that for the discussion and examples below, the following assumptions were made:

- The Series 2015A bonds were delivered 1/1/2015, with $5mm bonds maturing annually 1/1/2026 through 1/1/2040 having coupons of 5.00% and callable 1/1/2025 at par.

- The advance refunding bonds general information is stated in the charts but were all sold at par (i.e., no premium or discount).

(1) Picking an interest rate environment to execute the advance refunding – since the issuer can only execute one advance refunding, picking the market that achieves the issuer the maximum or targeted savings is important.

The chart below displays the results of delaying the execution of an advance refunding closer to the bond’s call date:

Note with static rates and reinvestment risk, the closer to the bonds’ call date the advance refunding is executed the more savings the advance refunding generates.

The chart below displays the impact if coupons/yield decline in the future and the bond issuer waited to execute the advance refunding:

By waiting until the call date, with interest rates and reinvestment rates dropping by 100 basis points (bp), the issuer can save an additional $6 million as compared to waiting until the call date with interest rates and reinvestment rates remaining static.

(2) Achieving the maximum return permitted in the escrow – the escrow is used to pay off the existing bonds in the future until they are called. The escrow is created by purchasing investment securities from the advance refunding bond proceeds. Regulations permit the issuer to reinvest the securities in the escrow at the issuer’s “borrowing rate,” called the arbitrage yield. If the issuer is unable to invest the escrow securities at their arbitrage yield, the advance refunding economics is reduced. (Note: taxable advance refunding escrow reinvestment earnings are limited to the refunded bonds arbitrage yield.)

The chart below shows the effects of executing an advance refunding with the escrow earning the maximum permitted reinvestment yield, and an advance refunding whose escrow is unable to earn the maximum permitted reinvestment yield by 50bp:

By losing 50bp of potential earnings in the escrow on a transaction with a 3-year escrow, the bond issuer will lose $1.4 million of potential savings.

(3) Losing Earnings on Outstanding Proceeds - If the refunded bond series have outstanding proceeds in funds (e.g., debt service reserve fund) that are invested at a rate that is higher than what is available on the newly issued refunding bonds, earnings will be lost on the proceeds of the refunded bonds. When a refunding is executed, the funds associated with the new refunding bond issue’s earning potential becomes limited to the refunding bond’s arbitrage yield, which might be lower than the existing bond’s arbitrage yield, thus reducing the overall economics of the refunding transaction. (Note: taxable advance refunding escrows reinvestment earnings are limited to the refunded bonds arbitrage yield.)

The Muni Gamble

So why are advance refundings a Muni Gamble?

- Is today’s market the best time to achieve maximum cash flow savings or should the issuer wait and see if a future market can achieve more savings? If the markets improve (i.e., interest rates drop) after the advance refunding is executed, the issuer cannot take advantage of the improved opportunity. But note that if rates back up (i.e., increase), the issuer will potentially not be able to achieve today’s savings amount.

- In today’s market, can the advance refunding escrow achieve its full earnings potential? If the refunding escrow is unable to achieve its full earning potential, potential savings associated with the advance refunding will be reduced. Should the issuer wait to execute the advance refunding until the escrow can achieve its full reinvestment potential? To the extreme, should the issuer wait until the call date to refund the bonds, thus eliminating any potential reinvestment loss? Of course, waiting opens up the potential for market moves increasing/decreasing the advance refunding coupons, thus changing the dynamics of the transaction.

- Does the advance refunding have any “hidden” economic costs that when included in the savings analysis lower the savings? If so, is the reduced savings enough to potentially have the issuer delay the execution of the advance refunding until those losses are reduced or are eliminated?

Disclaimer: DebtBook does not provide professional services or advice. DebtBook has prepared these materials for general informational and educational purposes, which means we have not tailored the information to your specific circumstances. Please consult your professional advisors before taking action based on any information in these materials. Any use of this information is solely at your own risk.