Understanding how bond discounts are amortized is crucial for accurate financial reporting and compliance. In this blog, we’ll break down the key concepts of discount bond amortization, explore the methods used to calculate it, and explain how DebtBook’s Premium/Discount Amortization feature simplifies this process for issuers.

Plus, you can simplify your bond amortization process with our Effective Interest to Maturity Premium/(Discount) Amortization Template—the most recommended method. This easy-to-use template allows you to input maturity details for any outstanding bond issue, calculate a precise Effective Interest Amortization Schedule, and compare a bond’s Face Value Stated Interest to its Book Value Effective Interest.

Download now to streamline your calculations and ensure compliance with accounting standards.

What is Premium/Discount Bond Amortization?

When bonds are issued, they can be sold at either a premium or a discount depending on how their coupon rate compares to current market interest rates. Understanding the amortization of these premiums and discounts is essential for accurately tracking bond value over time.

Premium Bond Amortization

A bond is sold at a premium when its coupon rate is higher than prevailing interest rates, meaning investors are willing to pay more than the bond's face value. The premium amount represents the extra amount above par that the bondholder pays to receive higher interest payments. Over the life of the bond, this premium is gradually amortized (reduced), meaning it is spread out over the bond’s remaining life.

The goal is to bring the bond's carrying value down to its face value by the maturity date. Amortization is typically done using the straight-line method or the effective interest method, with the latter being more precise as it adjusts for time-value-of-money.

Discount Bond Amortization

A bond is sold at a discount when its coupon rate is lower than the market rate. Investors pay less than the bond’s face value because its interest payments are less attractive. The discount is gradually amortized, meaning it is added back to the bond's carrying value over time.

By the time the bond reaches maturity, the carrying value equals its face value. Like premiums, discount amortization can be calculated using the straight-line or effective interest method.

- Refund Tracking

- Automated Financial Reporting

- Historical & Future Loan Tracking

- Simplified Continuing Disclosure Management

- Filtered Views of Your Portfolio

- Automated Long-Term Obligation Disclosure

- Schedule Creation Functionality

- Automatically Generate Journal Entries

Differences in Premium/Discount Amortization Methods

When it comes to amortizing bond premiums and discounts, there are several methods that affect how the amortization is calculated and recognized over time. Each method introduces small differences that can impact the effective interest rate and the bond’s carrying value.

Here’s a look at the four main methods and their distinctions:

Effective Interest Rate to Maturity

In this method, the premium or discount is amortized based on the bond’s effective interest rate over its full maturity period. This means the amortization schedule accounts for the time value of money, and the interest expense recognized each period reflects the bond's current carrying value. Since this method uses the bond’s market yield at issuance and assumes the bond will not be called, the amortization is evenly spread but changes slightly based on the bond’s remaining balance. This method is generally more accurate and reflects the true cost or benefit to the investor or issuer across the bond’s life.

Effective Interest Rate to Call

This method operates similarly to the effective interest rate to maturity, but it assumes that the bond will be called before its maturity date. As a result, the amortization schedule accelerates to match the shortened life of the bond, affecting the bond’s carrying value and the effective interest rate. Because callable bonds often have a higher likelihood of being redeemed before maturity (especially in a declining interest rate environment), this method is more appropriate when the issuer is expected to call the bond early. The interest expense recognized will be higher over the shorter period.

Straight-Line

The straight-line method divides the total premium or discount equally over the bond’s term, meaning the same amount of amortization is recorded each period, regardless of changes in the bond’s carrying value or interest rates. While this method is simpler and easier to calculate, it does not reflect the time value of money, which means it might not provide as accurate a representation of the bond's true interest expense or income over time. The straight-line method can lead to slight discrepancies in interest expense recognition compared to the effective interest methods.

Straight-Line by Maturity

This method is a variation of the standard straight-line approach but assumes that the bond will be held to maturity rather than being called. It evenly spreads the premium or discount over the bond’s full life to maturity, similar to the effective interest rate to maturity method but without factoring in the bond’s carrying value or market interest rate adjustments. This method is often seen as more practical for simplicity in accounting but may not accurately reflect market conditions if the bond is called before maturity.

Key Differences:

- The effective interest methods provide more precision by incorporating the bond’s carrying value and the time value of money, which makes them more reflective of the actual yield and cost to investors.

- The straight-line methods are easier to implement but can result in discrepancies in the reported interest expense, especially if market rates fluctuate or the bond is called early.

- Effective Interest to Call can accelerate amortization when bonds are callable, whereas Straight-Line by Maturity spreads it evenly without considering early redemption possibilities.

How do you Amortize a Bond Discount?

When an investor purchases a bond at a discount, the difference between the face value and the purchase price is considered the bond discount.

For instance, if a bond with a $1,000 face value is purchased for $950, the $50 difference is the discount. Over time, this discount is amortized, meaning it’s spread out and recognized as interest income over the remaining life of the bond.

Importance for Financial Reporting

For financial reporting purposes, amortizing the discount provides a clearer picture of the bond’s actual yield and the investor's earnings over time.

It ensures that the income recognized on the bond reflects the true economic benefit of holding a discounted security, which is critical for accounting standards like ASC 842 and GASB 87 when managing leases or debt.

DebtBook’s Premium/Discount Amortization Feature

DebtBook’s Premium/Discount Amortization feature allows clients to easily track their amortization of original issuance premium/discount (“OIP” or “OID”) within their DebtBook profile.

Using the data from the "Maturity Detail" tab in your Issue Detail view, DebtBook automatically calculates the original issue premium or discount for each maturity.

Once you select your preferred amortization method, we seamlessly generate the corresponding premium/discount amortization schedules.

Via DebtBook’s Accounting settings, users have the ability to select one of four methodologies for amortizing their premium and discount:

- “Effective Interest Rate to Maturity”

- “Effective Interest Rate to Call”

- “Straight-Line"

-

“Straight-Line by Maturity”

Below we walk through how we calculate each methodology and why we support these four methodologies specifically.

Effective Interest Rate to Maturity

GASB No. 62 requires that original issue premiums or discounts be amortized using the "interest method." DebtBook’s Effective Interest Rate methodology aligns with this standard, offering an easy way to comply by selecting the "Effective Interest Rate to Maturity" option in your Accounting Settings. This method calculates premium/discount amortization for each maturity individually and combines them into a full amortization schedule for the entire issue.

How it’s Calculated

The Effective Interest Rate method compares a bond’s Face Value Stated Interest to the bond’s Book Value Effective Interest.

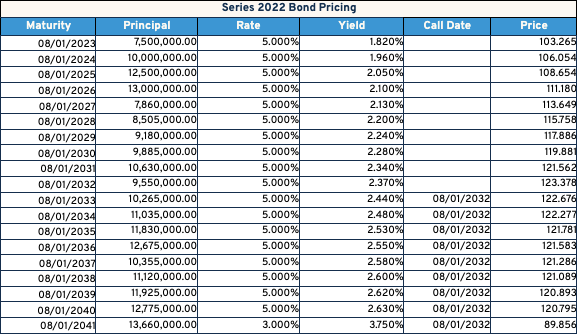

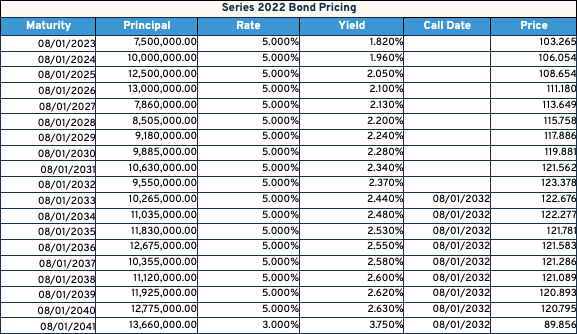

Let's walk through what each of these terms mean and how they are calculated using our “Series” information pictured below.

What is Face Value Interest?

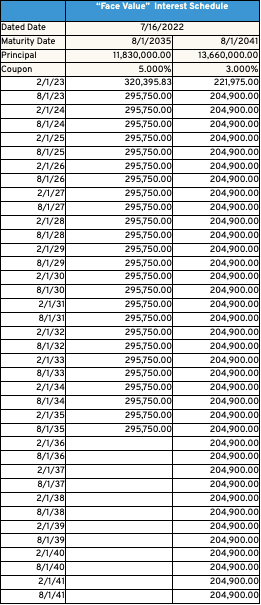

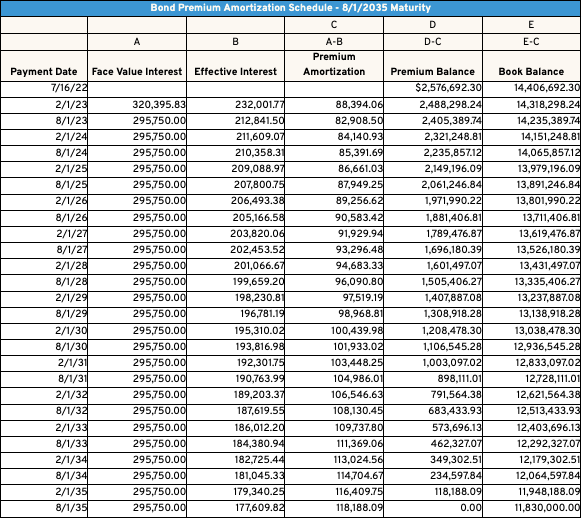

Face Value Interest simply means the actual interest paid through the life of the maturity. Using our examples above, the stated interest is outlined in the below chart for our 8/1/2035 and 8/1/2041 maturities.

What is Book Value Effective Interest?

Book Value Effective interest is calculated similar to traditional Face Value Interest, but uses different inputs. “Book Value” represents the Par Amount of a maturity plus/minus the outstanding premium/discount amount on the maturity.

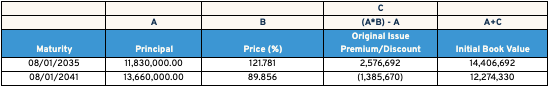

Using our previous examples, see below for the initial book value of our bonds maturing on 8/1/2035 and 8/1/2041.

Calculating Book Value and Effective Interest Using Yield to Maturity

As we amortize the premium or discount, the bond’s book value reduces to its par amount by the maturity date. To calculate Book Value Effective Interest, multiply the Outstanding Book Value by the bond’s Yield to Maturity.

For callable premium bonds, the Yield to Maturity differs from the Stated Yield in offering documents.

For example, the 8/1/2035 maturity has a Yield to Maturity of 2.973%, higher than its Yield to Call of 2.53%. DebtBook calculates Yield to Maturity to ensure accurate Effective Interest values, with the formula:

Outstanding Book Value * Yield to Maturity = Effective Interest

To calculate the effective interest amount on our First Interest Payment date for our 8/1/2035 maturity, we would do the following calculation:

$14,406,692 * 2.973% = $232,001.77

Putting it All Together

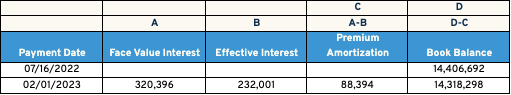

Now that we know the component parts of the Effective Interest Rate Method, we can put them together to generate our premium/discount amortization schedule. To calculate the amount of premium amortized on each payment date, the following calculation is applied:

Face Value Interest - Effective Interest = Premium/(Discount) Amortization

See the example below for the calculation of Premium Amortization on the first Interest

Payment date for the 2035 maturity of the Series 2022 Bonds:

Our Face Value Interest of $320,396 less our Effective Interest of $232,001 results in a premium amortization of $88,394 on our first interest payment date on 2/1/2023. We can then reduce our premium balance and book balance by the $88,394 premium amount, to give us our remaining outstanding Book Balance of $14,318,298 on 2/1/2023.

This calculation is then continued through the maturity date of the bonds.

See the full premium amortization table for the 8/1/2035 maturity below:

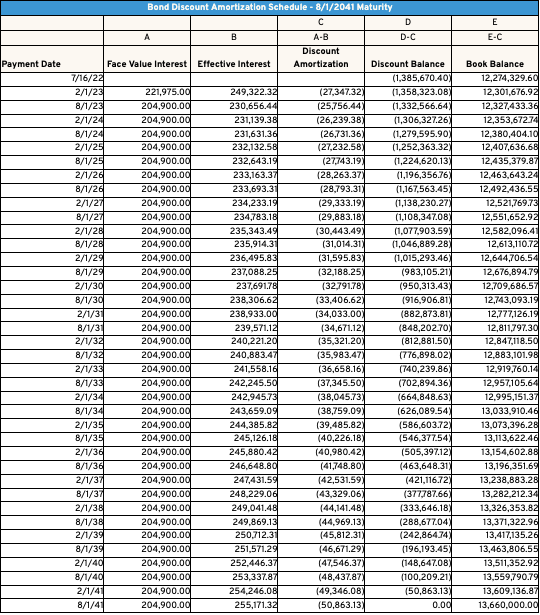

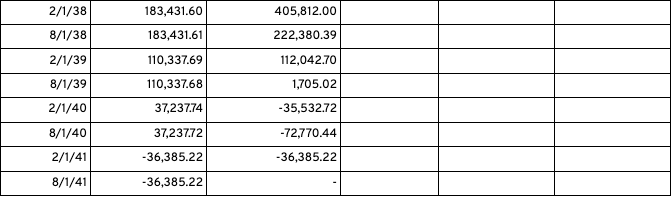

Provided below is the same calculation for our 8/1/2041 maturity, which is amortized to maturity as a discount bond.

These calculations are applied individually to each maturity within a series when using the Effective Interest Rate method.

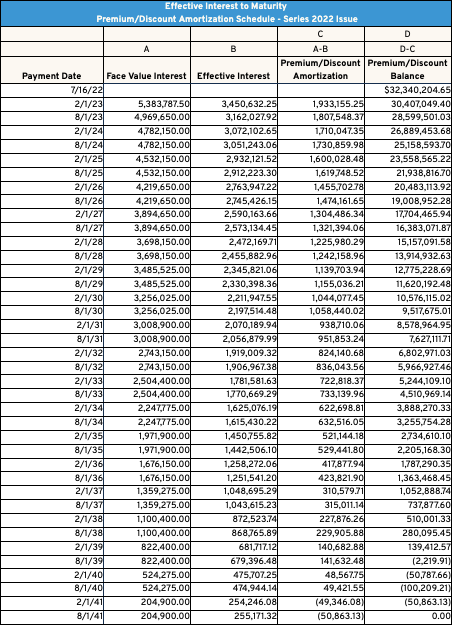

See below for our total premium/discount amortization schedule for our Series 2022 issue.

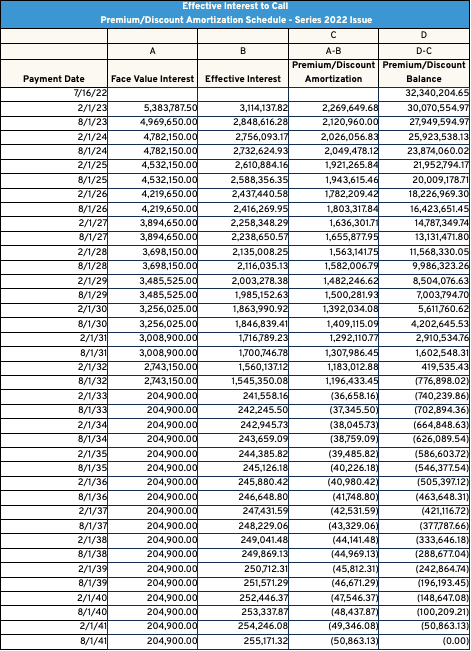

Effective Interest Rate to Call

DebtBook also offers another acceptable form of the Effective Interest method that takes into account the callability of maturities.

In the event a bond is a callable premium bond, there is a higher likelihood that the bond will be called before or at the call date. DebtBook’s Effective Interest Rate to Call method amortizes the premium on these maturities with that likelihood in mind.

Understanding the Effective Interest Rate to Call Method for Premium and Discount Bonds

The Effective Interest Rate to Call method considers whether the stated yield is the Yield to Call or Yield to Maturity. Municipal bonds must be reported at their “yield to worst,” the lowest possible yield.

For callable premium bonds (where the coupon rate is higher than the yield), the stated yield usually assumes the bond will be redeemed at the call date rather than maturity, resulting in a lower yield.

For example, in the Series 2022 Water and Sewer Revenue Bond issued on 7/16/2022, the yield reflects this.

The 8/1/2035 maturity of our bond series has a 5.00% coupon and a stated 2.53% yield, and is callable on 8/1/2032. The 2.53% yield represents the yield assuming the bond is called on 8/1/2032, as compared to the Yield to Maturity which assumes the bond is outstanding until maturity.

As the yield to call represents the lower yield or “yield to worst”, this is the yield that is used in the Effective Interest to Call Methodology.

![]()

The opposite is true for bonds that are callable but structured as discount (coupon<yield) bonds.

See the example below.

For a discount bond, the "yield to worst" is the yield to maturity, not the yield to call. As a result, the price of a callable discount bond is based on the yield to maturity, which generates the discount.

![]()

Using our example, the callable premium bond maturing on 08/01/2035 would amortize fully by the call date of 08/01/2032. In contrast, the discount bond would amortize until 08/01/2041, its maturity date.

Non-callable bonds are always amortized to their maturity date. The math for the Effective Interest Rate to Call is the same as for Effective Interest Rate to Maturity, except callable premium bonds amortize in full by the call date. If refunded in advance or on the call date, the premium will be fully or nearly fully amortized by that time.

Below is the total amortization schedule for our Series 2022 issue, illustrating how premium amortizes at the call date while the discount continues.

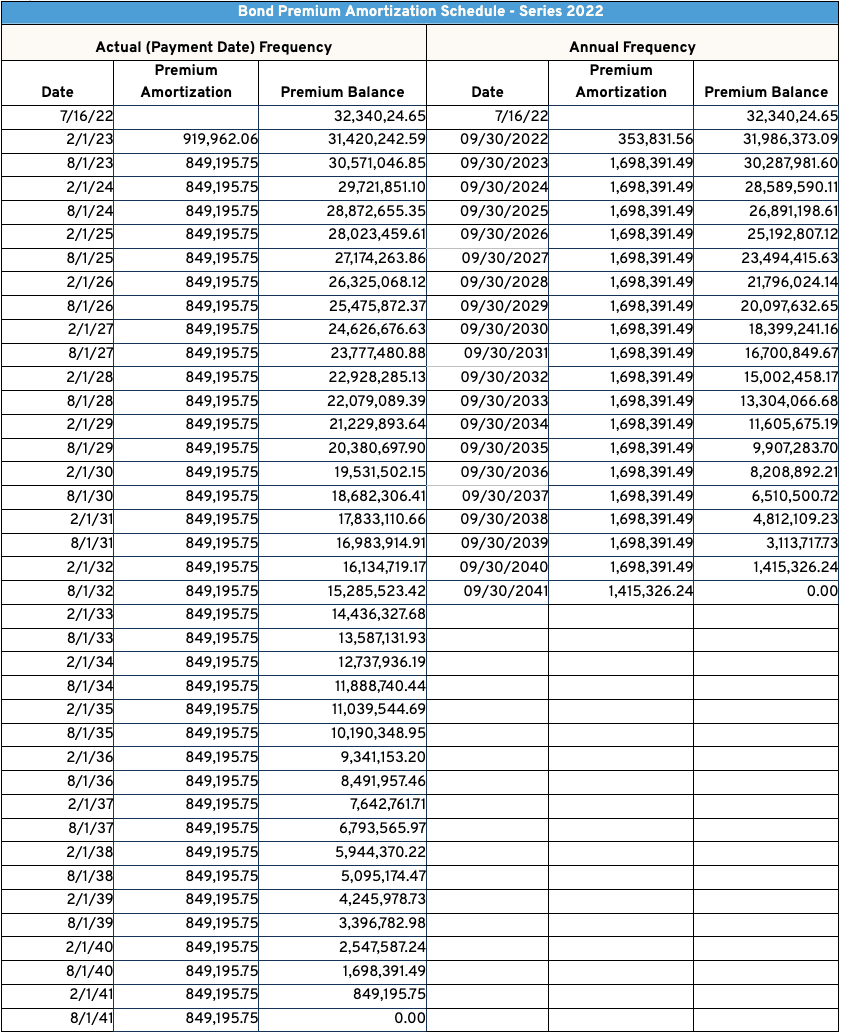

Straight-Line Method

While the Effective Interest Rate method is the standard approach, many issuers use the simpler Straight-Line method for premium/discount amortization. In this method, the total premium or discount is divided evenly over the number of days from the bond's dated date to its final maturity.

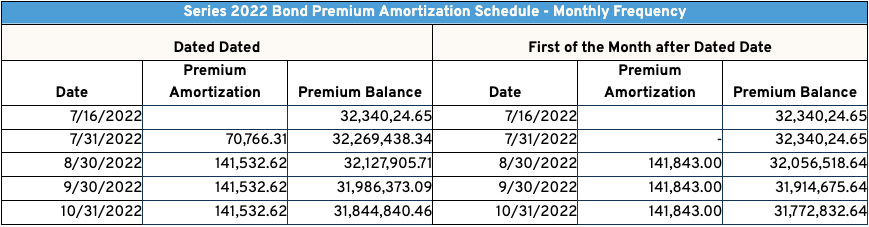

For example, the Series 2022 Bonds, with a total premium of $32,340,205 and a maturity date of 8/1/2041, amortize $4,717.75 per day based on a 30/360 day count. This daily amortization allows flexibility in aligning schedules with different frequencies.

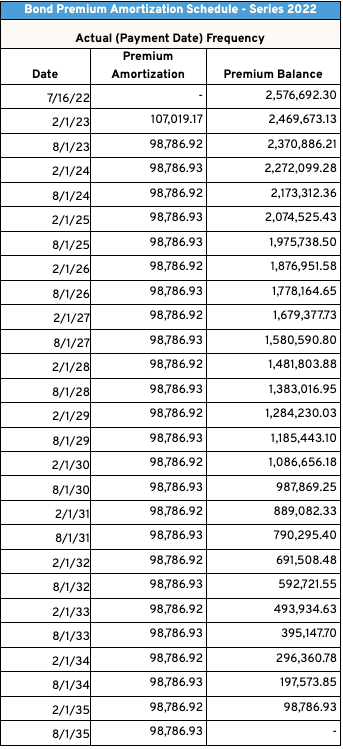

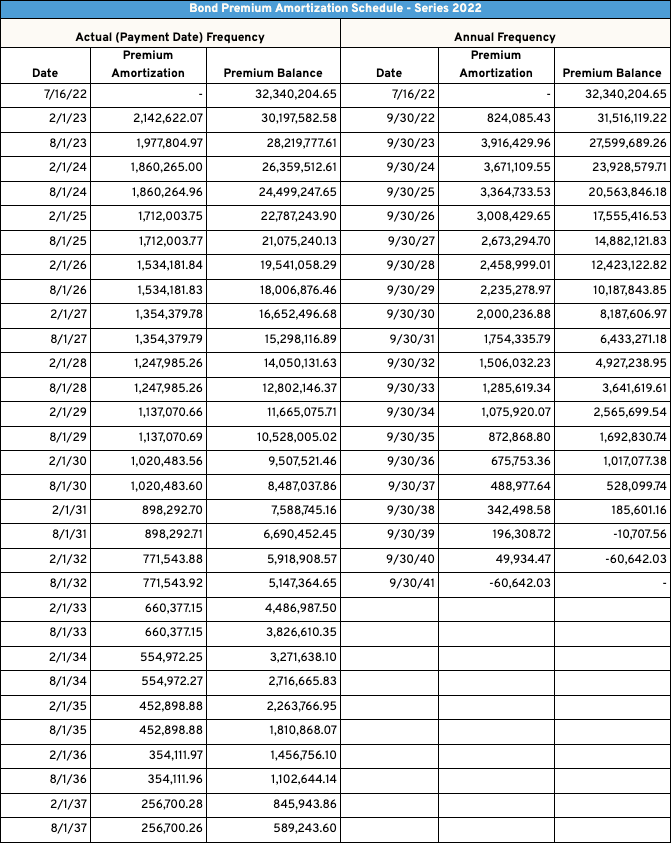

Straight-Line by Maturity Method

On April 5, 2023, DebtBook introduced the “Straight-Line by Maturity” method based on client feedback. This approach combines elements of both the Effective Interest and Straight-Line methods by amortizing the premium or discount for each maturity to its specific maturity date.

The total premium or discount for each maturity is divided by the number of days from the bond's dated date to the maturity date, creating a level amortization. For example, the 8/1/2035 maturity from the Series 2022 Bonds has a net premium of $2,576,692.30, resulting in a daily amortization of $548.82 over 4,695 days.

These calculations are applied individually to each maturity within a series when using this Straight-Line by Maturity method. See below for our total premium/discount amortization schedule for our Series 2022 issue on both an Actual and Annual Frequency.

Note the dynamic of the premium/discount amortization decreasing on each principal payment date when viewing the Actual frequency schedule, reflecting the amortization’s ending for that maturity on its maturity date:

Setting Your Amortization Start Date

With the straight-line method, DebtBook allows users to choose when to start amortizing the premium/discount. The default setting begins on the bond’s dated date.

For example, if the bond is dated 7/16/2022, the application will amortize 15 days in July and then 30 days each month (based on a 30/360 day count). Alternatively, you can select “First of the Month after Dated Date,” which starts amortization on 8/1/2022, skipping July. This option results in slightly different amortization schedules based on your choice.

Day Count Methodology

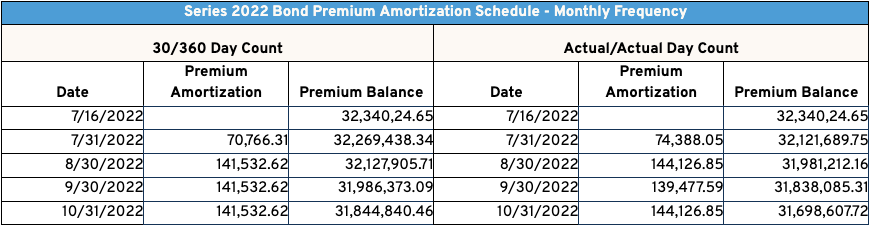

DebtBook allows users to choose between a 30/360 or Actual/Actual day count for daily premium/discount amortization, whether using the Effective Interest or Straight-Line methods. The difference between these methods is shown in the graphic below. The Actual/Actual method amortizes based on the actual days in each month (e.g., 31 days in October), while the 30/360 method assumes a consistent 30 days per month.

Conclusion

Understanding and accurately applying discount bond amortization is important for financial reporting and compliance with standards like ASC 842 and GASB 87. By choosing the appropriate amortization method, issuers can ensure precise calculations that reflect the true economic impact of their bonds.

DebtBook’s Premium/Discount Amortization feature offers a range of methodologies, allowing users to select the approach that best fits their needs, whether it’s the Effective Interest Rate or Straight-Line method. With flexible options and advanced calculations, DebtBook simplifies the amortization process, making it easier for issuers to manage their bond portfolios with confidence.

Simplify your bond amortization process with our Effective Interest to Maturity Premium/(Discount) Amortization Template, the most recommended method for accuracy and compliance. This powerful tool allows you to input maturity details, calculate precise amortization schedules, and compare a bond’s Face Value Stated Interest to its Book Value Effective Interest. Streamline your calculations and ensure your financial reporting is always on point.

Related Debt Management Reading

- Feature Flash Video: New Issuing Structure with Sizing

- Breaking Down the Math Behind Municipal Bonds

- Debt Service Calculator for Tax-Exempt Bonds

Disclaimer: DebtBook does not provide professional services or advice. DebtBook has prepared these materials for general informational and educational purposes, which means we have not tailored the information to your specific circumstances. Please consult your professional advisors before taking action based on any information in these materials. Any use of this information is solely at your own risk.