Many public finance organizations struggle with maintaining sufficient cash reserves for daily operations, future growth, and unforeseen challenges. A weak cash position not only jeopardizes liquidity, but also places an organization in an uncertain financial state. Effective cash management is important for overall success, which is why it’s critical that the treasury team has a keen understanding of their organization’s cash position.

In our latest blog in the Treasury Foundations series, we’ll discuss the role the treasury team plays in cash positioning management and dive into the intricacies involved from forecasting and balances, to their final decisions.

Definition: Cash Position

The quantity of cash that a company is holding at a given point in time. (Essentials of Treasury Management (ETM) - 6th edition, 2020).

Importance of Cash Position

The treasury team's fundamental responsibility is to determine and manage cash position. This is necessary because the daily flow of funds into an organization rarely matches the outflows and requires coordinating actions, known as cash management, to ensure that financial obligations are met in a timely manner.

By evaluating an organization’s bank account, the treasury team can establish the cash position and guarantee each account maintains the requisite amount of funds. This helps organizations lower bank fees, prevent overdraft charges, and identify surplus cash.

Cash Management: Polling and Positioning

Cash management comprises two parts: polling and positioning.

Once connected to their bank and

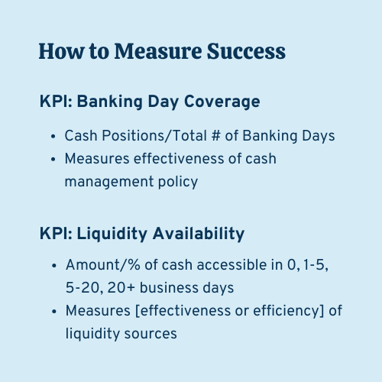

Another fundamental task for treasury teams is knowing, or estimating, the organization’s liquidity position. Liquidity position is a longer term view of the organization’s cash position, e.g. over a week, month, or year, and supports planning purposes. Perfect, or 100 percent, cash visibility would allow a treasurer to ‘know’ their cash and liquidity positions at all times. However, most organizations operate with less than perfect cash visibility which means they’ll need to estimate or forecast some or all of their liquidity positions. Building a liquidity position forecast is dependent on three building blocks: accounts, balances, and transactions.

*Why a banking day? Banking days are days when bank branches are open. The Federal Reserve sets the bank holiday schedule. While most bank holidays align with days when offices are closed, some do not, like the day after Thanksgiving. If banks are open, transactions can happen and organizations should know their cash position.

Bank Account Structure and Forecasting

Funds flow in and out of an organization through the cash management system composed of the bank accounts that an organization opens, closes, and maintains. From an operational perspective, the accounts are fixed and determine the flow of funds.

Typically, organizations utilize a concentration structure where funds are collected in accounts opened for the following reasons:

- Specific revenue types

- Sales tax

- Utility fees

- Departments

- Parking

- Public safety

- Payment rails

- Credit cards

- Checks

The funds are typically concentrated into a master account which then funds various disbursement accounts:

- Specific purposes

- Payroll

- Vendor payments

- Departments

- Procurement

- Facilities

- Payment rails

- Checks

- Wire transfers

- ACH

Whether concentration structures are in place or not, it’s critical to understand and track the inflows and outflows of funds to manage fraud prevention and forecasts. For example, ACH can create exposure to fraud from unauthorized transactions if an account is not protected by ACH blocks and filters. For accounts where no ACH activity should occur, it’s a good idea to implement ACH blocks to prevent any ACH transactions from clearing the account. If an account needs ACH services, specific filters of what entities can be paid or can withdraw (e.g. for payroll taxes) can be placed on an account to control payments and minimize fraud exposure.

For forecasting, having an effective bank account structure can help segregate predictable, reportable, and/or large transactions from smaller and/or ad hoc transactions. This will allow a cash manager to develop more accurate projections based on the cash flow behaviors that vary by purpose, department, or payment rail.

Behaviors might be driven by factors such as:

- A set schedule

- Payroll

- Seasonality

- Property tax

- Tuition

- Projects

- Capital expenditures

- Contracts

- Debt services

- Leases

- Subscriptions

A robust forecast, supported by a bank account structure that’s aligned with the organization’s primary cash inflows and outflows, provides better visibility into the organization’s cash requirements for strategic planning.

Available Balance vs. Ledger Balance

Balances provide the starting point for the cash position process, more specifically the opening available balance. The available balance is the “portion of the commercial account ledger balance against what the bank normally limits the account holder to draw” and is the cash management ‘version of the truth’ in regards to cash positioning.

This is different from the opening ledger balance which is the “commercial account balance that is the result of the total debit and credit activity as of a specific date and time. There is no indication of funds availability or usability.” (ETM, 2020) Ledger balance is also known as the book, gross, or statement balance and is the accounting ‘version of the truth’ and the basis for account reconciliations and financial reporting.

The relationship between the two is:

- Ledger Balance less Net of the 1-6 day available funds buckets= Available Balance.

Available balance is also known as good funds or investable balance - which are important terms in relation to the ending or closing cash position.

Once an opening available balance is set, usually early in the day of the cash positioning process, the cash manager can start their process to connect the actual and forecasted transactions that will happen that day which will increase or reduce the available balance.

Transactions: Liquidity Sources or Uses

If balances provide the starting point of a financial journey, then transactions are the twists and turns that happen along the way. For treasury purposes, transactions are categorized as liquidity sources or uses.

Sources are the inflows into an account or cash management system. They can be any type of cash inflow: revenue such as taxes and fees, bond proceeds, credit card sales, or intergovernmental transfers/grants. Sources also include the cash on hand (opening available balance), credit facilities, draw programs, investments, and bond proceeds that can be transferred into an operating funds system.

Uses are the cash flows out of the cash management system. Uses include payroll, vendor payments, debt service, and capital expenditures. Uses can also include the repayment of credit facilities and the investment of excess funds.

Decision Time: Invest, Borrow, or Repay

Once all the balance and transaction information is collected, cash managers need to make a decision by their daily cutoff time. Daily cutoff times are set based on various factors including investment and borrowing notification requirements. Decisions include whether to invest/divest and borrow/repay based on the cash position. Another driver for a daily cutoff time is the time needed to complete any tasks needed to either fund a cash deficit or invest a cash surplus based on the cash position.

Conclusion

To summarize, cash management is necessary because of the mismatch in timing between cash inflows and outflows. It consists of two main functions: bank polling and cash positioning. Bank polling is gathering data about accounts, balances, and transactions. Cash positioning is structuring the data into information to help a cash manager make a decision on a daily basis about whether to fund a shortfall or invest a surplus.

Related Treasury Reading

- The Strategic Role of Treasury in the Public Sector

- Foundations - Bank Polling (Connectivity = Visibility)

Disclaimer: DebtBook does not provide professional services or advice. DebtBook has prepared these materials for general informational and educational purposes, which means we have not tailored the information to your specific circumstances. Please consult your professional advisors before taking action based on any information in these materials. Any use of this information is solely at your own risk.