Unlock Strategic Cash Management

Gain full control over cash flow to minimize risk, reduce costs, and improve financial performance.

Over 2,100 government & nonprofit organizations are using DebtBook to modernize how they work

Modern Cash Management

Too many treasury teams find themselves bogged down by inefficient spreadsheets and scattered data, leading to missed revenue opportunities and heightened risk. Relying on outdated tools to complete essential tasks is not only time-consuming but also prone to error—leaving little room for the strategic work that truly matters.

DebtBook’s Cash Management application changes the game by offering a purpose-built, powerful, and secure solution for managing cash flow and liquidity.

With Cash Management, teams can shift their focus from time-consuming tasks to smarter, strategic decision-making while streamlining workflows to improve cash flow and liquidity management.

Modern Cash Management

Too many treasury teams find themselves bogged down by inefficient spreadsheets and scattered data, leading to missed revenue opportunities and heightened risk. Relying on outdated tools to complete essential tasks is not only time-consuming but also prone to error—leaving little room for the strategic work that truly matters.

DebtBook’s Cash Management application changes the game by offering a purpose-built, powerful, and secure solution for managing cash flow and liquidity.

With Cash Management, teams can shift their focus from time-consuming tasks to smarter, strategic decision-making while streamlining workflows to improve cash flow and liquidity management.

How you can use Cash Management

- Track upcoming cash flow with ease and adjust as needed for accurate projections

- Use manual entries or rely on statistical modeling for precise updates

- See debt payments alongside cash forecasts for full financial clarity

- Monitor all connected bank accounts in real time for unusual activity

- Quickly flag unauthorized transactions

- Reduce fraud risk with consolidated, actionable insights

- Instantly view real-time cash across all accounts

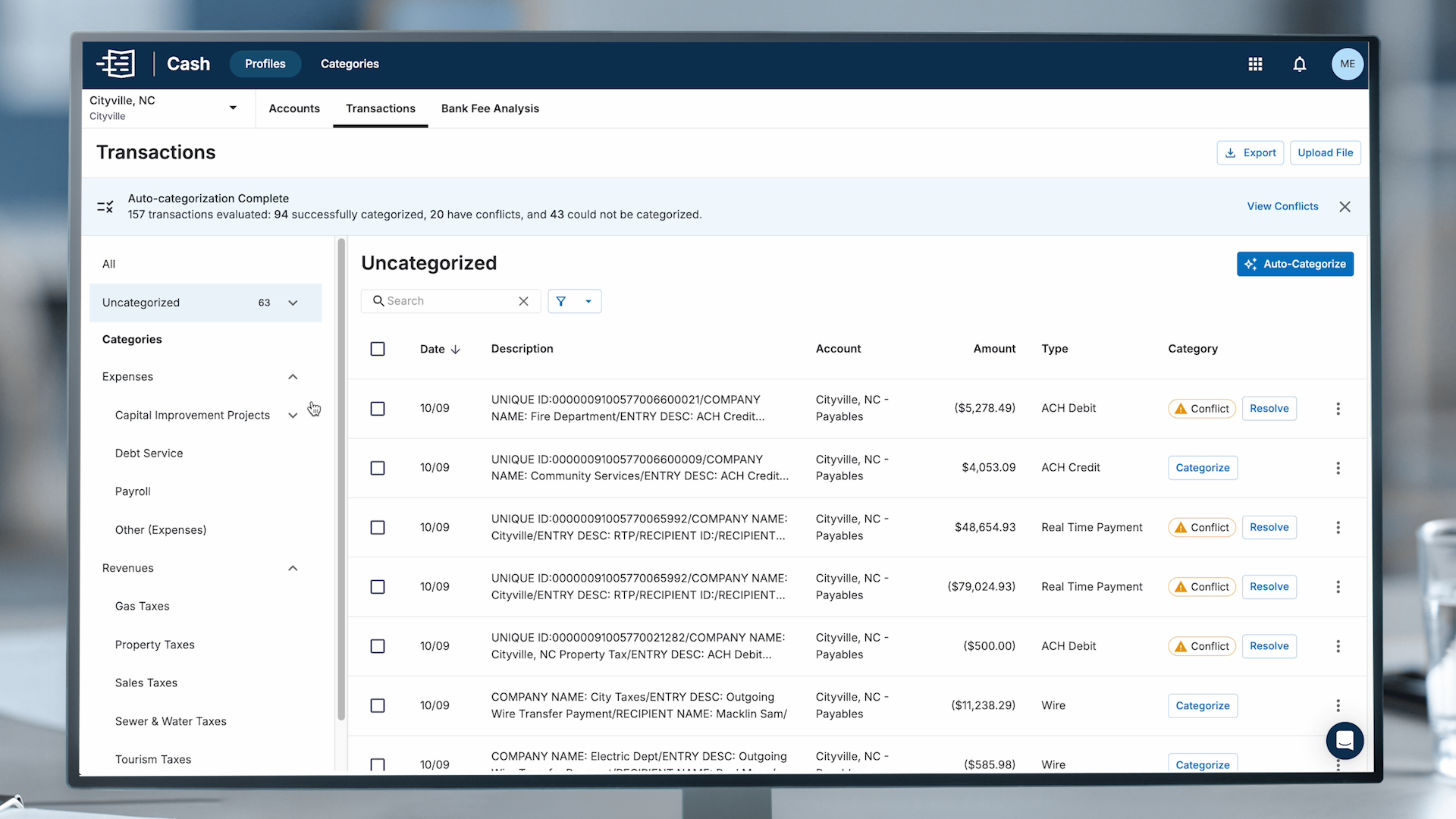

- Automatically categorize transactions for faster insights

- Receive alerts when balances fall below your set thresholds

See how it works

Popular Features

Comprehensive transaction details for users to label, search, and perform historical analysis, like spend down.

Quick and accurate forecasts that generate daily cash positions over a chosen time period for easy review.

Increased safeguards as consolidated data enables teams to quickly flag fraudulent transactions.

Secure and cloud-based storage to centralize institutional knowledge and eliminate key-man risk.

Native integration with DebtBook’s other treasury platforms for easy debt service payment validation.

Unlimited internal and external seats for easy access within your team or outside professionals.

Detailed cash positioning comparing projected cash with targets and highlighting disparities.

Aggregated bank data through external connections to a variety of US financial institutions.

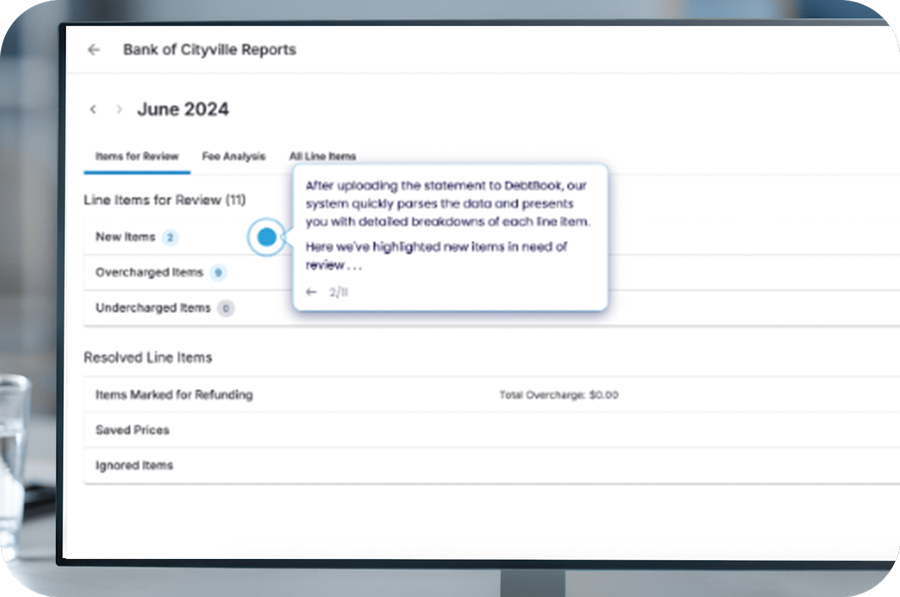

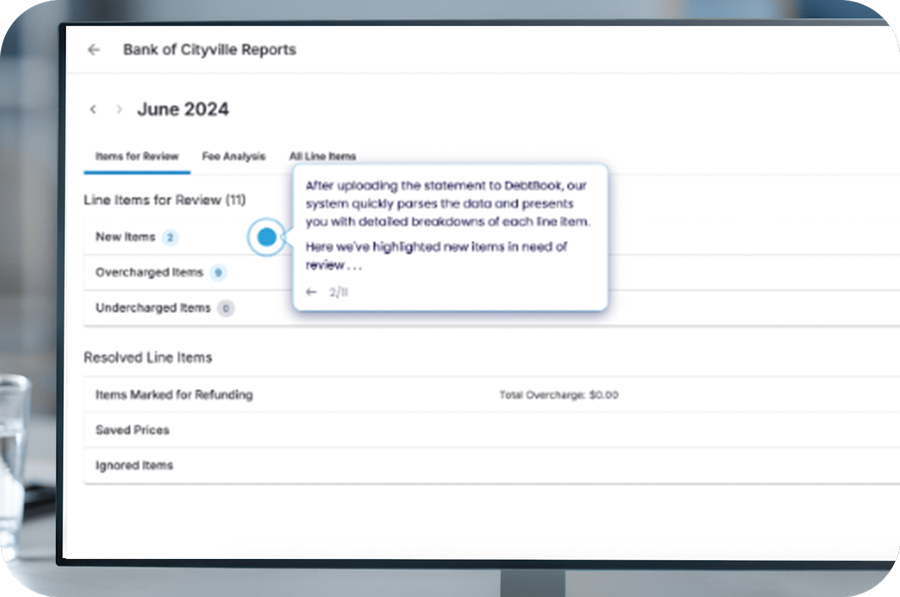

Simplified bank fee analysis and reconciliation to ensure efficient liquidity management.

Enhanced data confidence by reducing errors associated with antiquated methods and manual processes.

Daily balance tracking with centralized data from multiple sources.

Watch: Auto Categorization

See, in two minutes how our auto categorization feature allows you to easily build accurate and reliable cash forecasts so that you can invest and borrow more strategically and thereby improve your financial performance.

Watch: Auto Categorization

See, in two minutes how our auto categorization feature allows you to easily build accurate and reliable cash forecasts so that you can invest and borrow more strategically and thereby improve your financial performance.

Find hidden savings and boost earnings credit with Bank Fee Analysis

Better understand the fees your organization is being charged, identify any discrepancies, and ensure balances are being held efficiently to offset fees without excess balances earning zero interest.

During preliminary testing, we helped treasury teams identify millions of dollars of idle cash that, when invested, could be earning between $200K to $2M on average in interest revenue on an annual basis.*

*The on average $200K-$2M per annum calculation is based upon average excess balances identified in operating accounts that could be invested through a daily liquid money market fund returning 5% APY.

$200K to $2M

Per annum benefit identified*

Watch: Positioning Feature Flash

Discover how DebtBook’s Cash Management application empowers you to effortlessly create accurate and reliable cash forecast in our 2-minute Feature Flash.

How hard will the software be to use?

We know, no matter how powerful our system is, it won’t be of any benefit to you if it’s too difficult to use. So we offer:

- A user-friendly design that balances simplicity and depth

- DebtBook University, a robust library of dozens of training courses, updated quarterly

- A platform, according to McHenry County, IL that’s “really intuitive” and “easy for anybody to understand.”

For the City of Vista, this ease of use pays dividends come audit time:

“With a system as easy to use as DebtBook, I can feel confident giving my auditors access, knowing they will get the information they need without needing my assistance or waiting on a response from me. This saves me, and our auditors, a ton of time during audit season.”

How difficult will the software be to use?

We know, no matter how powerful our system is, it won’t be of any benefit to you if it’s too difficult to use. So we offer:

- A user-friendly design that balances simplicity and depth

- DebtBook University, a robust library of dozens of training courses, updated quarterly

- Streamlined implementation and accessible ongoing support

Delivering exceptional implementation experiences

Because we know the last thing you need is an arduous implementation process, our experienced team is dedicated to ensuring a seamless and outstanding experience.

And we have the testimonials to prove it:

Great Support Team, efficient communications, excellent software

Gloria Huang

Budget & Financial Analyst, Natick, MA

The DebtBook implementation experience... has exceeded my expectations

Kevin Delaney

Director of Finance, Town of Berlin, CT

Some of the best customer service and responsiveness I've seen in a very long time.

Marie Friedman

CFO, Burlington, VT

Discover more about our implementation process:

Why should I partner with DebtBook?

At DebtBook, we've worked hard to establish ourselves as the industry leader in government and non-profit treasury management by delivering world-class solutions that have changed the way teams work.

We believe we stand apart from the competition and are committed to being a trusted partner to you with staying power.

- The only cloud-based platform designed specifically for government and nonprofit teams

- Over 2,100 customers

- 140+ employees

- SOC 1 & 2 data integrity and security compliance and single sign-on functionality

- Built by government and nonprofit finance professionals

Get a Firsthand Look at DebtBook

Ready to see what DebtBook can do for you? Let’s set up a personal 30-minute demo. We’ll walk you through every aspect of DebtBook, so you can see how we’re changing the game for organizations like yours.

Start changing the way you work. Schedule a demo today!